We can help you set up everything you need and with the right advice, we'll help you get up and running in no time.

Brookson is here to give you help and guidance, leaving you to get on with the job at hand. If you’re going into contracting for the first time, we can set you up in as little as 24 hours.

Going into contracting can be liberating, lucrative and give you a whole new lifestyle. However, in order to succeed, it’s vital you look after your income and make sure you remain completely compliant when it comes to your finances.

We're here to guide you through the smaller matters of your self-employment, helping you get the most from your take-home pay and maintain peace of mind when it comes to the contracts you work on.

If you're new to contracting, we've got you covered!

We'll help you navigate complexities like IR35 easily

We can set up a Limited or Umbrella Company within 24 hours

We can give you advice on Financial Planning should you need it

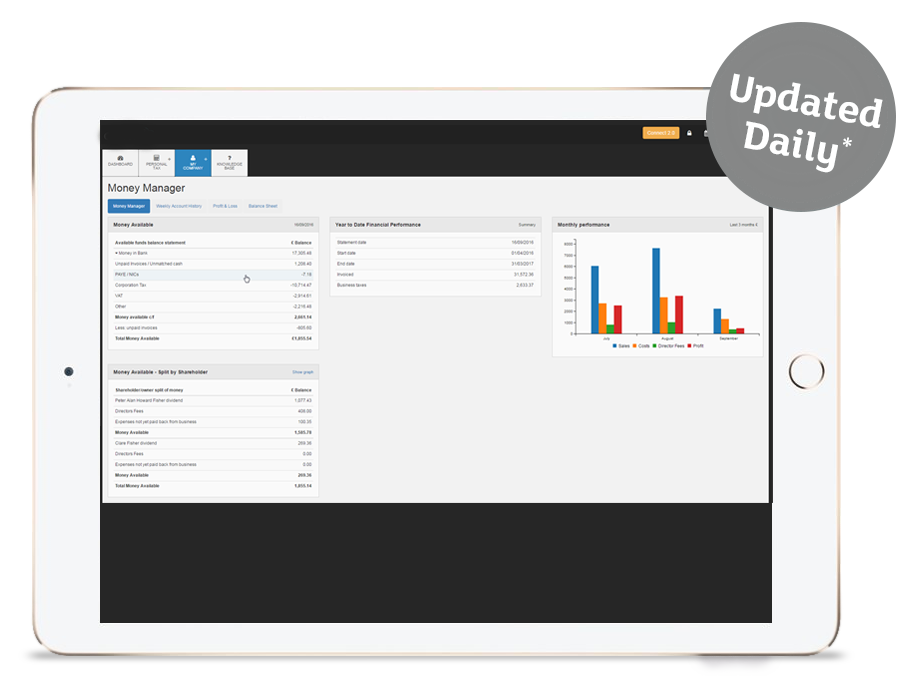

From start to finish, Brookson can help you on your way to contracting. We have developed our own Connect Portal with the ability to give you real-time updates on your finances and allow you to add your receipts and invoices on the go. It’s time to discover a flexible, specialist accounting service that allows you to perform at your best.

With opportunities to work as a contractor in practically every industry and sector, this form of employment is a fantastic way to build experience, develop skills and move your career forward more flexibly and on your terms. As the world of contracting becomes more familiar to you, typically you will also find that a wider range of work will become available as the list of clients you work with increases.

Taking the plunge and beginning your new career as a contractor can be daunting, however. Contracting is completely different to permanent employment. As a contractor, you have the power to decide how you want to be paid. After settling into a new role, one of the first things each contractor needs to do is ensure they have the appropriate system in place to manage their finances. Whether you choose to operate via an umbrella company or as a limited company, getting this right is vitally important. Whatever system you choose and however you manage your finances as a contractor, ensuring that you comply with current tax regulations set out by HM Revenue and Customs (HMRC), while also making sure your net pay is as high as possible, is paramount.

Here at Brookson, we’ll help you find the best option for you and make sure that we are there to support you at every step of the way in your journey as a contractor.

We put your financial worth first, helping you determine whether it’s best to operate under an umbrella or set up a limited company. Many of our clients find setting up as a limited company is simply the best way to maximise their earning potential.

Incorporating your business and becoming a limited company will ultimately reduce your tax obligations allowing you to take home more while leaving the paperwork to us. We can set up you Limited Company for you, giving you all the benefits of a small business without the hassle. You can find out more about Limited Companies in our guide. It might seem like a confusing time, but we've been helping people like you, since 1995, and we were started by contractors, for contractors with the simple message that there must be a better way.

Once we know the best solution, be it umbrella or limited, we take you through the process from start to finish. You'll have a dedicated contact who will be able to assist you and we'll get you set up with all the systems you need to get started, including Connect our innovative online portal.

The calculations are for illustration purposes only and are based on a series of assumptions.

The calculations are based upon the following criteria:

Take our short quiz to help you decide.

Do you earn more than £15 per hour?

Do you plan to take on contracting for longer than three months?

Are you happy to do about 30 minutes paperwork per month?

Are you happy to submit your own invoices and expenses?

If you're a higher earning contractor or freelancer, setting up as a Limited Company may be your best option.

We would always recommend discussing your individual circumstances in full with a member of the team before selecting your chosen way of working.

Book a consultationWith our Umbrella employment Solution, you are employed by us. We pay you directly via PAYE and take care of all the necessary tax and NI calculations and payments on your behalf.

We would always recommend discussing your individual circumstances in full with a member of the team before selecting your chosen way of working.

Book a consultationFrom setting up a limited company and registering at Companies House to reviewing your contracts for IR35 compliance, our services tackle every facet of your venture, saving you time, stress and energy. Our accountancy team supports hundreds of contractors running a business just like you; we’re more than capable of helping your transition to self-employment.

We’ll eliminate the risk of unexpected tax penalties, as well as advising you on the changes to IR35. You can monitor your finances in real-time using Connect, our cutting-edge platform, which can link to your bank account and provide you with real-time insights on your finances and our help desk is on standby six days a week.

Accredited by the FCSA, APSCo and REC, you know you’re in safe hands with Brookson. We’ll consult with you before any course of action is established, ensuring you get exactly what you need and that you are able to handle your tax efficiently.

Our aim is to get you on board, with no exit fees or tie-in period, within 24 hours. So, if you’re a contracting first-timer, what are you waiting for?

Brookson have managed the financial affairs of over 90,000 individuals. Our customers satisfaction is our top priority, we regularly invite our customers to provide feedback and review the Brookson service as customer reviews enable us to continually improve the service we provide.

Please be aware that by submitting your details you are accepting to receive future updates regarding Brookson services. Your information may also be disclosed to carefully selected third parties.

Full details of the Data Protection Policy can be found here.

To ‘opt out’ of all future Brookson marketing material, please email [email protected]

Rights to Privacy: Your details will not be disclosed to any third party that is not associated with Brookson Limited.

By Using our website you are agreeing to our cookie policy.

Read the full details of our privacy policy.