We know that, as a contractor, you don’t have the time to be chasing your accountant or trawling the internet for financial advice. You need proactive support that will optimise the way you work, and the best accountants should recognise this. As a contractor, your choice of contractor accountant can have a huge impact on your experience of this form of employment and the financial advice you receive. This makes choosing a firm that understands your specific business needs and the specialised industry in which you work vitally important.

If you don’t feel you’re getting the support you require or if paying too much for services you don’t need or want has left you thinking, ‘I need an accountant that better works for me’, switching accountants to Brookson could be your best option.

A solid relationship between a contractor and their accountant is the foundation upon which future success and profitability can be built. However, too often we hear stories from contractors who feel their accountant is not providing them with the best advice, with their income suffering as a result. As a contractor, you should expect your accountant to not only manage your financial accounts but also ensure that you are complying with relevant tax legislation and are operating as tax efficiently as possible.

So, if you don’t think you’re receiving value for money, or if you’re looking for accountants with specialist knowledge and experience in contractor accountancy, it may be time to change.

Are you struggling to understand your accounts and financial position?

Have you recently been hit by unexpected tax bills and fees?

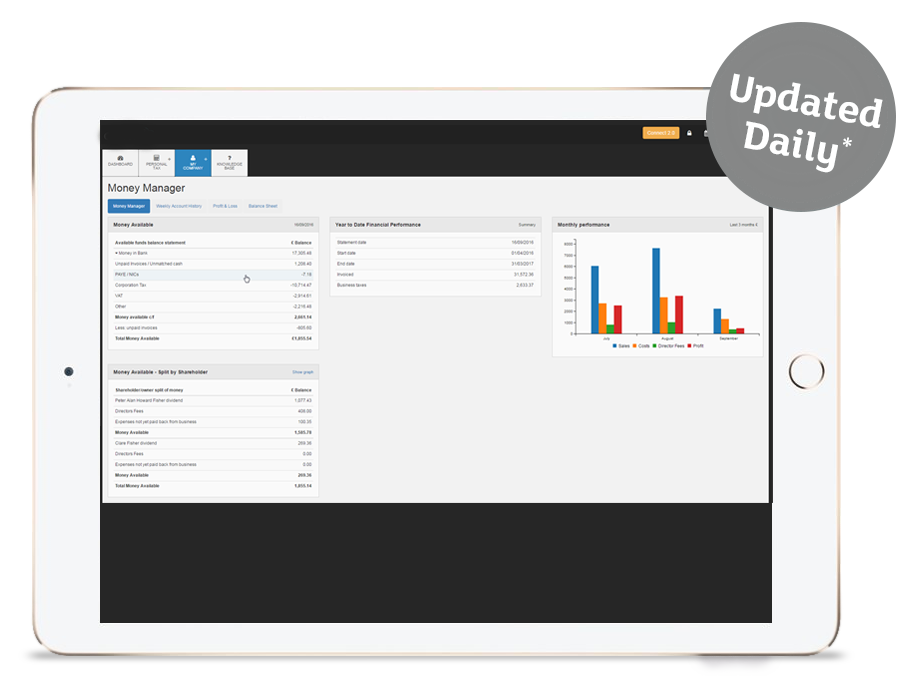

Do you want an up-to-date view of your business finances?

Discover a better way to manage your accounts by switching to Brookson today.

Here at Brookson, our financial and legal experts specialise in supporting contractors and can help you move accountants quickly and seamlessly. Our specialism in contracting means we’re perfectly placed to give you the visibility and control that you deserve. From IR35 compliance to limited company accountancy support and umbrella employment solution, we’re committed to saving you time and hassle in every aspect of your work.

You can access a dedicated accountant for contractors and log into our Connect platform whenever you need it. That means you’ll avoid nasty surprises and find it easier to navigate changes to the evolving world of work, wherever you are in your self-employment journey.

Concerned about switching contractor accountants? You shouldn’t be. We can get you up and running with new accountants in as little as 24 hours, dealing with your old firm for you to ensure a smooth transition to Brookson.

We offer transparent pricing and take pride in providing value for money, with no hidden extras to worry about.

So, if your accountancy firm isn’t delivering on its promises, or you feel you might have outgrown your accountant, get in touch with us today - changing accountants with Brookson could not be any easier.

You can access a dedicated accountant for contractors six days a week, and log into our Connect platform whenever you need it. That means you’ll avoid nasty surprises and find it easier to navigate changes to the evolving world of work, wherever you are in your self-employment journey.

With Brookson, switching accountants is free, and simple!

Switching accountants might seem daunting, but it’s actually a straightforward process. Many people worry about the effort and potential complications, but with the right support, it’s simple and stress-free.

At Brookson, we will deal directly with your previous accountancy firm, ensuring a smooth and seamless switch. All you need to do is reach out, and we’ll take care of the rest – from setting up your account to notifying your former accountant.

Changing accountants can be incredibly quick. At Brookson, we can get you up and running with your new contractor accountancy services in as little as 24 hours. This swift process ensures minimal disruption to your business while allowing you to focus on what you do best.

Brookson have managed the financial affairs of over 90,000 individuals. Our customers satisfaction is our top priority, we regularly invite our customers to provide feedback and review the Brookson service as customer reviews enable us to continually improve the service we provide.

Please be aware that by submitting your details you are accepting to receive future updates regarding Brookson services. Your information may also be disclosed to carefully selected third parties.

Full details of the Data Protection Policy can be found here.

To ‘opt out’ of all future Brookson marketing material, please email [email protected]

Rights to Privacy: Your details will not be disclosed to any third party that is not associated with Brookson Limited.

By Using our website you are agreeing to our cookie policy.

Read the full details of our privacy policy.